Skills for Future Tax Professionals

*Some updates on this subject are here.

I often hear tax professionals around me wondering what skills our profession should have under the rapid progression of data and technology. The confusion, or more accurately the dilemma seems to be antagonistic option of resourcing established data scientists who adapt to the tax problem domain, or to expect tax professionals to learn data analytics, or even deeper.

I suspect similar questions are on many non-tech industry professionals’ mind. As a tax professional specialised in transfer pricing, I think sharing my personal journey of professional development maybe helpful for others.

I hold a master degree in economics from University of Nottingham so econometrics and statistics are not unfamiliar territories to me. Upon joining an industry job at a large international advertising group, I decided, as any responsible transfer pricing professional would do, to know everything about this industry for value chain analysis. In the first two months into my new job, I took numerous courses, attended seminars and talks to acquainted myself with various buzz words in the wonderful world of digital marketing, impressions, PPC, programmatic, SEOs, DMPs until I hit data science, then under the disguise of marketing science. It all started making sense and I immersed myself in this fascinating cross discipline area with enough ever changing new materials to learn over a lifetime.

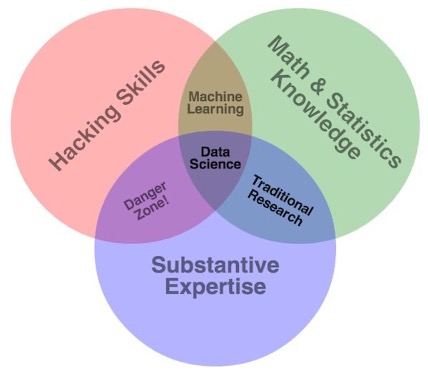

In my very first data science class, this concise but illustrative Venn diagram was shown to us to explain what skills this emerging discipline requires:

To say that I was apprehensive would be an understatement but I pressed on. The journey, especially the process of getting comfortable with programming such as Python, has been both challenging and exhilarating for me. I have an insatiable learning appetite, but details of me climbing the steep learning curve would be an entirely different post. What I want to focus on here is my vision of the future tax professional - from a skillset perspective.

Every organisation, individual has accumulated substantial amount of data. There seems to have been an eternal debate on which is more important, the data itself or the work on it. Even if it sounds like a chicken and egg conundrum at a glance, I agree with the line of thought expressed by Elon Musk:

“Personally, I think that engineering is better because in the absence of the engineering, you do not have the data. You just hit a limit. And yeah, you can be real smart within the context of the limit of the data you have, but unless you have a way to get more data, you can’t make progress. … The limiting factor, if you will, is the engineering. And if you want to advance civilization, you must address the limiting factor.“

This is in line with his well articulated way of thinking and solving problems - approaching the problem from first principles rather than by analogy. Assuming we could agree on the point that the engineering of data is at the core of solving problems instead of the data per se, I move onto my next point - what do we need, in order to address the future skillset required by our profession in tax?

I think it is still the domain knowledge in taxation but augmented in a much more powerful way. Enabled by both data itself and data science skills, be it a painstakingly data cleansing and structuring, a straightforward data analysis, or more advanced predictive analysis using machine learning techniques.

Irrespective of the function or industry we work in, we often need problem driven solutions. In tax, the problem may be some uncertainty of outcome due to a tax litigation case, or some mundane time consuming tasks like preparing VAT returns, or local transfer pricing documentation reports, or newly acquired data such as the country by country reports requiring our attention to find patterns for potential risk management. These problems are often hidden: specific to organisation or industry. They can only be uncovered by specific domain knowledge and experience over time in an organisation. Only when a domain expert can ask a detailed enough question on the problem with clear goals, data and the associated data science skills would be able to address it in any meaningful way.

I highly recommend one of my recent thought-provoking readings: life 3.0: Being human in the age of artificial intelligence by Max Tegmark on the discussion of what kind of goals we should give to our machines in order for them to function to our advantage.

The landscape of data science and programming is ever changing, and evolving rapidly. To pursue talents with any specific knowledge of a particular programming language or analytical framework may be less efficient in the long run. Instead, a candidate’s grasp of foundational programming concepts and their methodology to problem solving are much more important in my opinion to keep up, adapt and eventually lead amidst a changing environment.

Then what exactly is the skillset required for a tax professional in the near future? I think it is much more important to look for future talents who are likely to be active problem seekers and solvers, chronic hungry learners with inquisitive minds and strong perseverance.

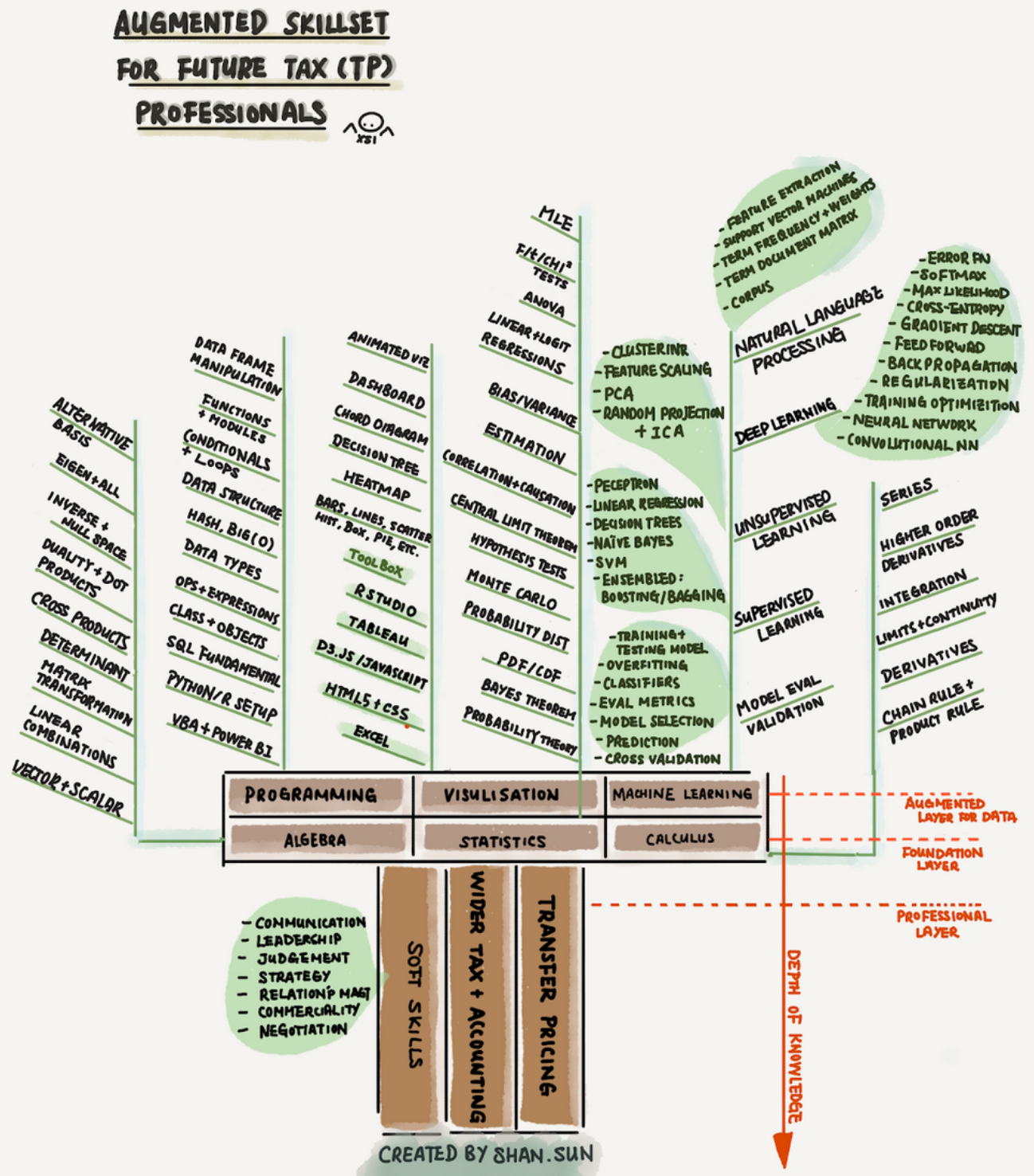

For existing tax professionals, veteran or freshly entered, it would be strategically necessary to acquire even the basics of data science. I detailed my learning journey to date in a T-shaped semantic tree.

“It is important to view knowledge as sort of a semantic tree — make sure you understand the fundamental principles, ie the trunk and big branches, before you get into the leaves/details or there is nothing for them to hang on to.” - Elon Musk

For tax professionals, particularly in my personal case, being a transfer pricing (“TP”) specialist requires deep knowledge of TP, international tax, economics and accounting. But in the era of data and data science, we also need to acquire broader knowledge such as mathematics, statistics, programming and machine learning. However, as Musk pointed out, the broader knowledge is the leave, without well founded domain knowledge, they have nowhere to hang. Or more accurately they will not be able to solve a problem you can’t identify.

The T-shaped skills emphasises on deep knowledge of a particular field with much more knowledge in a wide range of potentially relevant topics. This approach to knowledge and learning allows future tax professionals to create and innovate, solve problems, and collaborate.